At CBA LIVE, Experts Discuss Cyber Security, What’s NEXT in Digital Banking

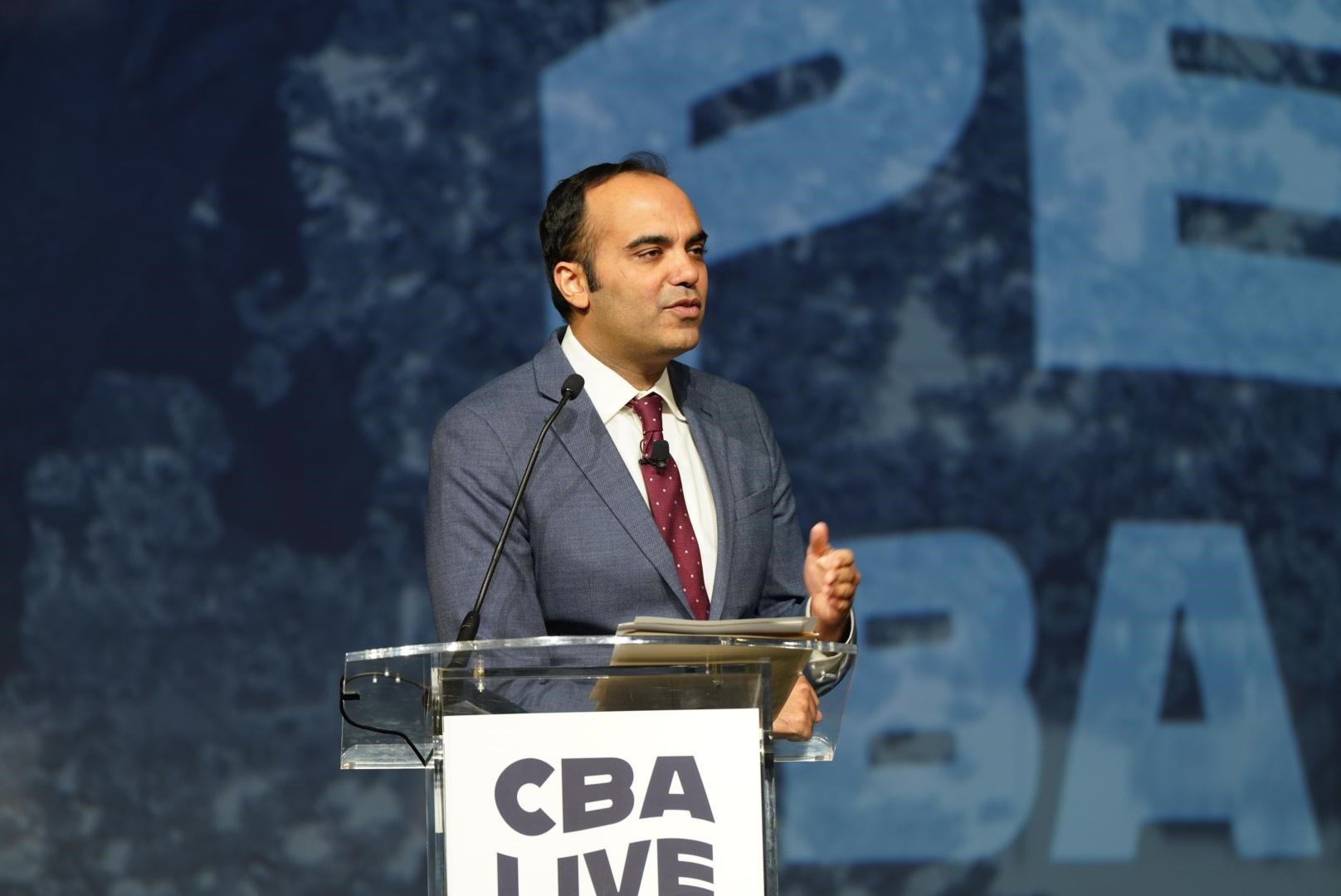

The Consumer Bankers Association (CBA) kicked off retail banking’s premier annual event – CBA LIVE – on Monday with opening remarks from CBA President and CEO Lindsey Johnson on the state of the industry as well as insights from the Executive Committee of CBA’s Board of Directors, which includes:

- Ryan Bailey, Head of Retail at USAA and CBA Board Chair

- Quincy Miller, President and Vice Chairman at Eastern Bank and CBA Incoming Board Chair

- Michelle Lee, Regional Banking Executive, Branch Banking at Wells Fargo and CBA Immediate Past Board Chair

During a discussion moderated by CBA’s Johnson, the Executive Committee discussed what they believe to be the biggest challenges and opportunities facing the industry.

In an audience poll, CBA LIVE attendees selected the economy as the biggest threat to the banking industry. However, Lee believed, looking beyond the last few weeks, cultivating and sustaining a robust talent pipeline poses the biggest challenge, noting:

“We are leading and employing a generation of people who think very differently than most of us who are leading them, and they are serving a customer base that is very different, that is more similar to them. So, I worry that we don’t get them and we tend to be more critical of where their values and their work ethics differ from ours versus really trying to understand what's important to them.”

Miller agreed, looking beyond the economy, which is always on the minds of those in the industry, adding:

“We’ve talked in the last two weeks more about contagion [...] And contagion is really fear. And what’s [scarier] than a bank being taken over from a cybersecurity perspective, and then the consumers lose confidence in us as an industry? That's why we spend billions of dollars protecting it.”

On areas in the banking industry they are most excited and hopeful about, Bailey responded:

“With the COVID pandemic, digitization accelerated drastically. And I do believe as an industry, we made lives much simpler as banking institutions. […] Us bankers think it’s very complex and deep. Consumers, they just want to transact and transact with ease. And we've changed a lot. So I'm very hopeful for that.”

Lee added:

“I’m most excited because I think as an industry we still understand the importance of the human and the emotional connection that we make with our customers. And so instead of being afraid that technology would replace, I think we’ve come to a place where we get that it’s not about one or the other. It really is about the combination of both.”

Miller also said:

“I think the past three years have united us more than we’ve ever been in facing the adversity that we’ve had to overcome as an industry. And so that can only bode for success as we’re […] focused together on how do we improve our businesses, how do we improve for our customers, and how do we make sure we strengthen our communities?”

Bailey underscored the significance of the industry gathering together this week, saying:

“I probably learn more from this conference in a single three or four days than I do in several months, because we have some of the smartest minds in the industry in this room. […] I love the dialog. I get to have meetings with people throughout the week […] in a short period time because we're all in one place, so it’s perfect.”

In addition to Johnson and CBA’s Executive Committee, the more than 1,700 attendees then heard from former Principal Deputy Director of National Intelligence, Sue Gordon, who discussed key concerns surrounding cyber security in the banking industry, and Bank of America’s Head of Digital, Nikki Katz, who provided a roadmap for banking in an increasingly digital world.

Cyber Security and the Banking Industry

Sue Gordon, former Principal Deputy Director of National Intelligence

On the financial services industry as a top target for scammers

“Of the seven industries that are most attacked, the government is number seven. You're [banks are] number two. And when you're attacked, it costs forty percent more to resolve. There is 40% more at stake financially than when any other industry is attacked.”

On the effectiveness of the banking industry’s cyber security efforts and its importance to national security

“It is remarkable on this front. It is ever present…The industry as a whole is, in my estimation, the most effective. […] Your industry has done some tremendous things in cybersecurity [..] If the financial industry is preeminent amongst our critical national infrastructures, then it shows in terms of how good you've gotten with cybersecurity. Doesn't mean it's not a problem. It just means you've gotten good."

Digital Banking

Nikki Katz, Head of Digital, Bank of America

On the need to prioritize the human experience in digital banking

“What industry is not completely transformed by technology at this point? All of our companies are. And yet we're in the business - in the banking business. We provide financial products and services. […] Ultimately, when I think about technology and what's next in digital, it is all about technology's ability to help us connect with those human beings.”

On digital’s ability to improve customers’ financial lives

“In banking, technology is in service of helping us make financial lives better. That’s really our goal. […] And we do that in a variety of ways. […] We want to know and value our customers. We want to have competitive, robust product offerings. We want to deliver expertise, guidance, advice, and we want to do all of that by meeting our customers where they are.”

Background

Entering its 14th year, CBA LIVE attracts the top leaders and influencers from across the country who gather to discuss the most pressing issues facing the retail banking industry. With more than 70 hours of dynamic programming and 14 forum sessions tailored to different bank segments, CBA LIVE offers key insights for professionals motivated to learn new trends and share ideas with the most influential decision makers in the business. To view press releases highlighting all three days of CBA LIVE 2023, click HERE.