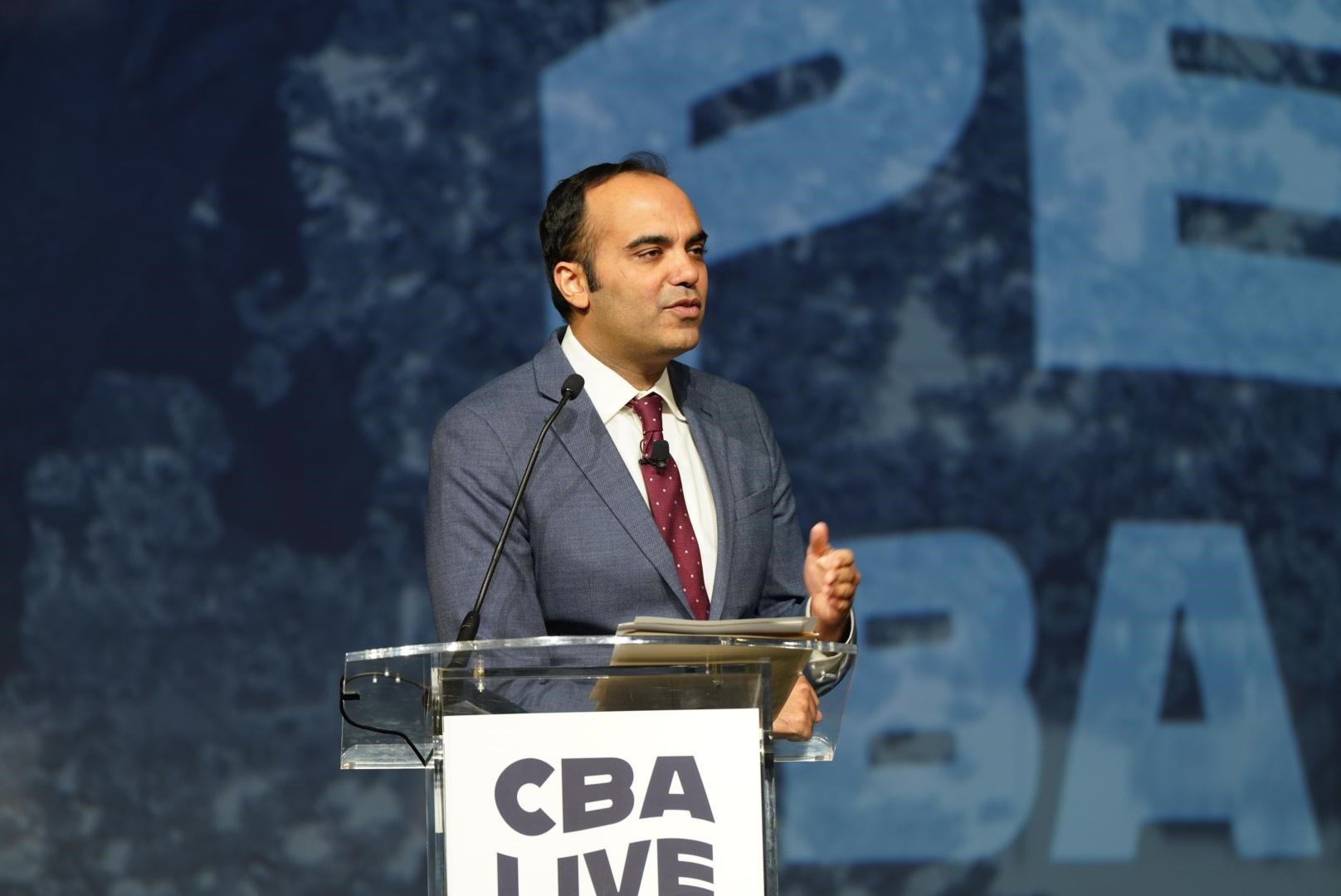

CFPB Director Chopra Gives Keynote Address, CBA’s Johnson Highlights Industry Priorities to Cap Day Two at CBA LIVE

WASHINGTON, D.C. – The Consumer Bankers Association (CBA) today continued retail banking’s premier annual event – CBA LIVE – with a keynote address from Consumer Financial Protection Bureau (CFPB) Director Rohit Chopra, immediately followed by a fireside chat between CBA President and CEO Lindsey Johnson and Punchbowl News’ Brendan Pedersen.

CFPB Director Chopra spoke about the competitive credit card marketplace, interest rates, and late fees, as well as his agency’s stance on open banking. These are issues that CBA has been deeply engaged on in previous months, including publishing a series of “Facts Matter” blog posts to correct the record on the Bureau’s misleading use of its own data in order to fit the Administration’s political narratives. To learn more, click HERE and HERE.

In addressing the banking industry’s commitment to working for the people, but noting some concerns regarding regulatory decisions, CBA President & CEO Lindsey Johnson said,

“This industry wants to do right by the consumer. We are nothing without trust. We are contending with fierce competitors in this room. But we're not going to be able to begin to have the right engagement [with regulators] and the right approach to these issues if we don't have at least a conversation and a process, that’s followed.”

When asked by Pedersen what CBA means by characterizing recent CFPB proposals as “politicized,” Johnson replied:

“The terms and the rhetoric that's used is really harming the conversation from the get-go. So that's part of it. The second part of it is when you stand up with the president and make an announcement about a product that's being offered in the market today that's perfectly legal and say that it's illegal, it makes it very difficult for this industry to respond.”

In response to the CFPB’s politicized attacks on banks, Johnson emphasized CBA and its member banks’ efforts to push back, including focusing on the facts and the significant progress financial institutions have made to support their customers, saying:

“In terms of credit cards and the consumer campaign, one thing that we've been very focused on is telling the story of all of these banks. Actually going out and telling folks what they do, what it means for consumers and pushing back when there's inaccurate facts out there. When you pull back something like overdraft, when you have a government set price, you ignore all of the innovations the largest institutions and leading have made in that space.”

Looking Ahead

Highlights for tomorrow, March 27, include:

- Mehlman Consulting Founder Bruce Mehlman will speak at 8:30 a.m. EDT on how policy, culture, and politics will drive the future of retail banking

To view the full detailed schedule, click HERE. To view the livestream, click HERE.

Background

Entering its 15th year, CBA LIVE attracts the top leaders and influencers from across the country who gather to discuss the most pressing issues facing the retail banking industry. With more than 60 hours of dynamic programming and 16 forum sessions tailored to different bank segments, CBA LIVE offers key insights for professionals motivated to learn new trends and share ideas with the most influential decision makers in the business.