CBA Statement on Consumer Need for Responsible Overdraft Protection

CBA Statement on Consumer Need for Responsible Overdraft Protection

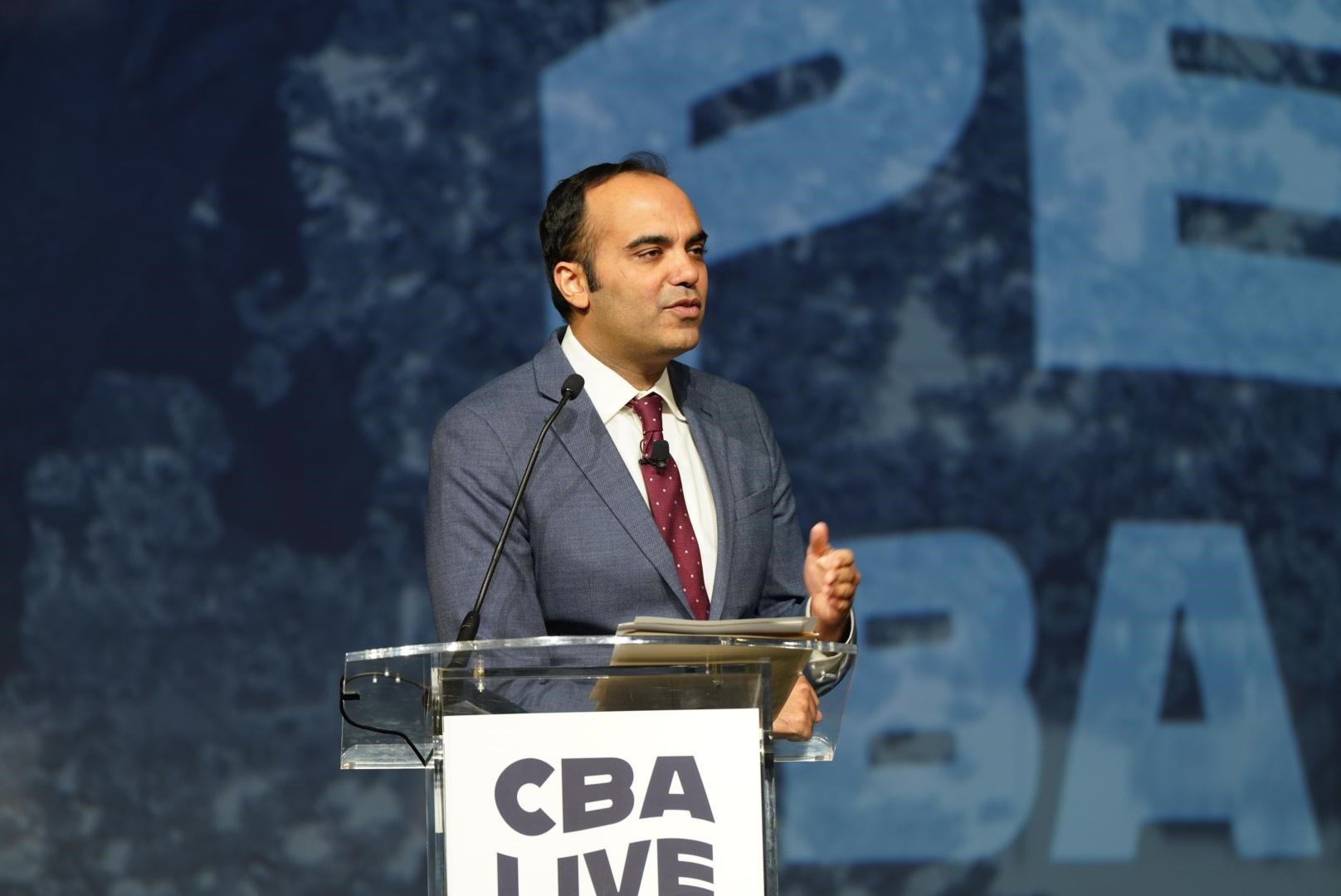

WASHINGTON – Consumer Bankers Association President and CEO Richard Hunt issued the following statement on the Overdraft Protection Act of 2019:

“Consumers understand and rely on overdraft services to cover emergency expenses instead of turning to unregulated lending sources. Placing limits on consumers’ ability to access these services only hampers their ability to obtain short-term liquidity to buy gas to get to work, food to feed families or pay for emergency medical expenses.

“Banks offer a variety of overdraft payment services in order to meet their customers’ financial needs and current regulations concerning overdraft services provide consumers strong protections through detailed disclosures and opt-in requirements.”

NOTE: Some have argued overdraft services are harmful to consumers and have assumed they were used by uninformed consumers. Research from Novantas has found these assumptions fundamentally incorrect. A majority of overdrafts come from highly informed consumers who use the services as part of informed decisions about what is best for their financial circumstances – and after clear, transparent disclosures from their bank.

Studies from the Federal Reserve, CFPB and Federal Deposit Insurance Corporation have shown a significant portion of Americans cannot cover a several hundred dollar emergency expense. Due in part to regulations, these consumers’ options are limited when it comes to receiving traditional forms of credit.

Placing restrictions on overdraft services would take away a well-regulated source of financial liquidity. This would cause consumer harm through returned payment fees, accumulation of higher merchant-imposed interest or late payment penalties for returned checks. Checks, as the Fed found, are most often used to pay consumers’ most important bills.

###

About the Consumer Bankers Association:

The Consumer Bankers Association represents America’s leading retail banks. We promote policies to create a stronger industry and economy. Established in 1919, CBA’s corporate member institutions account for 1.7 million jobs in America, extend roughly $4 trillion in consumer loans and provide $275 billion in small business loans annually. Follow us on Twitter @consumerbankers.