CFPB’s Credit Card Late Fee Proposal Disregards Data and Reality

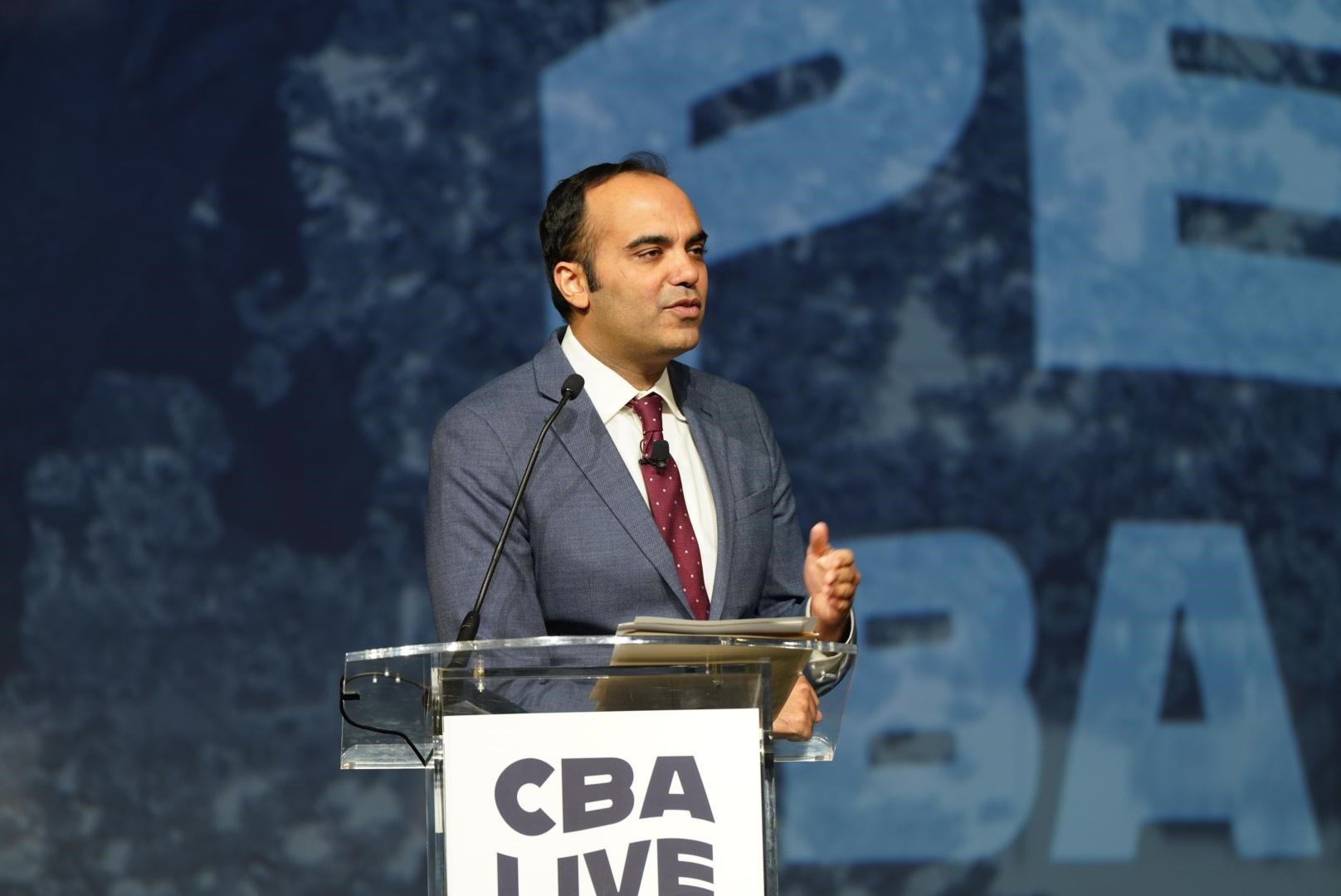

Consumer Bankers Association (CBA) President and CEO Lindsey Johnson today released the following statement after the Consumer Financial Protection Bureau (CFPB) announced a Notice of Proposed Rulemaking (NPRM) that would limit the safe harbor amount credit card issuers can charge consumers for overdue payments:

“This announcement is just the latest example of the Bureau seeking to advance a political agenda that will harm, rather than help, the very people they are responsible for serving. Millions of Americans rely on credit cards to make everyday purchases and cover emergency expenses. It is deeply unfortunate and puzzling that policymakers would take action that could ultimately limit consumers’ access to these valued financial products at a time when they are needed most.

“Further, continuing to conflate fees charged by well-regulated banks with those in other industries is not only disingenuous, it fails to reflect the fact that banks are required by law to provide clear and conspicuous disclosures. America’s leading banks remain committed to supporting hardworking consumers who have suffered from historic inflation over the past two years and continue to face unprecedented economic uncertainty today. Policymakers should be working in tandem with banks to advance this shared objective, rather than enact new policy without any regard to data or reality.”